Get 20% off this month when you try our services! tax preparation services w2 tax filing single filer best tax service near me

If Your Property Is Over-Assessed, You May Be Paying More Than Your Fair Share

Many New York property owners pay higher property taxes than necessary due to over-assessed property values. If your assessment is higher than the fair market value of your property—or higher than comparable properties—you may be eligible to file a Property Tax Assessment Grievance.

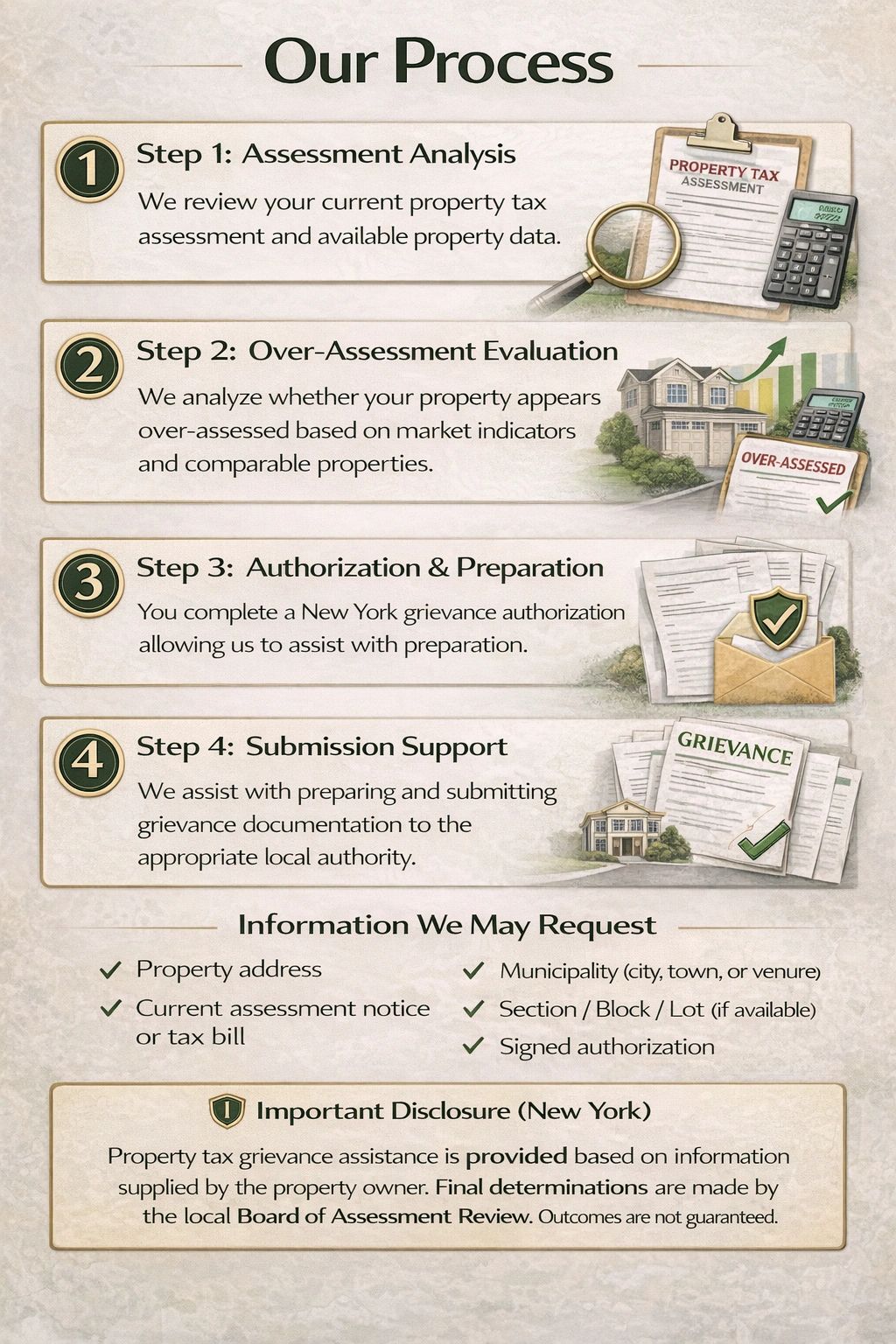

SIVAD Tax Service assists New York property owners with reviewing assessments and preparing grievance documentation in a professional, accurate, and timely manner.

What Is a Property Tax Assessment Grievance?

A Property Tax Assessment Grievance is a formal request submitted to your local municipality asking that your property’s assessed value be reviewed and corrected.

If approved, a reduced assessment may result in:

- Lower annual property taxes

- Ongoing tax savings in future years

- A fairer assessment based on market value

Our Property Tax Grievance Services Include

✔ Property Tax Assessment Analysis

✔ Over-Assessment Value Analysis

✔ Comparable Property Review (where applicable)

✔ NY Property Tax Grievance Authorization Assistance

✔ Residential & Small Commercial Properties

✔ Timely Preparation for Local Filing Deadlines

Who Should Consider Filing a Grievance?

You may benefit if:

- Your property taxes increased unexpectedly

- Your assessed value exceeds recent purchase price

- Similar nearby properties are assessed lower

- You believe your assessment is inaccurate or unequal

A structured, compliant approach to New York property tax grievance assistance.

SIVAD Tax Service

26 Years in Business • 30 Years of Professional Experience

File with Confidence

IRS-Compliant • Authorized E-File Provider • Federal & State Audit Support Included

Copyright © 2025 SIVAD TAX SERVICE - All Rights Reserved.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.